This is our commentary for soybeans on the month of February 2016. As mentioned in previous posts, Gann's 30 years cycle is due to turn during this month. There are other minor cycles turning during the whole length of this month.

The 30 years cycle should be the main focus during this month. According to our 2016 soybean roadmap and seasonal trend, February is a good month for seasonal lows. One possibility is that a market low will align with Gann's 30 year cycle leading up to a June 2016 top.

Accumulation on the side

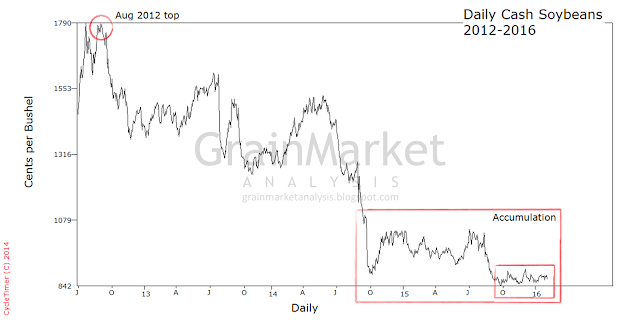

Figure 1 is a daily price-time chart for cash soybeans from the all time high top of 2012 to 2016. It shows a highlighted portion of the market since the October 2014 bottom. After this bottom, the market seems to have entered in an accumulation period. Gann states in his book How to Make Profits Trading in Commodities (pg.52):...At the end of a Bear Campaign, after the first sharp advance, there is a secondary reaction, then a long period of ACCUMULATION ON THE SIDE, with several moves up to the top of the range of accumulation and back to the bottom of the range of accumulation. The market is a buy at the bottom of this range and a safer buy when the tops of this range are crossed, as that is the BREAKAWAY POINT and a signal for fast advance...

Particularly, after the September bottom on cash soybeans and the November bottom in soybean futures, prices have been making slightly higher bottoms, moving up very slowly. Gann describes this as a creeping market (pg.19):

...in the early stages of a Bull Market, Wheat, Cotton, or any other Commodity will often move up very slowly, having small reactions and small rallies, but gradually working higher. After a long period of time, a creeping market will start a final run-away move, or what we call a grand rush, moving up very fast and having very small reactions...

|

| Figure 1 Daily cash prices for Soybeans at Central Illinois from 2012 to 2016. Accumulation on the side at the final stage of the current Bear market. Creeping market since September 2015. |

Summary

The year 2016 has 2 important cycles projected, most probably as bottoms (30 and 84 years cycles.) Since the market bottomed on late 2015 prices have been moving sideways and slowly making higher bottoms.Gann's 30 years cycle is due to turn on February 2016. A larger harmonic has a window of tolerance spanning the whole month, while a shorter harmonic was due to turn between late January to very early February. Unless this cycle aligned with February 2nd swing top, a bottom is expected during this month.

Update: Soybeans - February 2016

Ricardo Da Costa

Grain Market Analysis

hi

ReplyDeletethanks a lot ricardo

excellent job as always

Thanks Encient.

DeleteYes, I agree, fantastic and so easy to understand

ReplyDeleteThanks Stephen.

Delete